The Bitcoin Halving is a fixed event within the Bitcoin network that takes place approximately every four years. The reward that miners receive for adding a new block to the blockchain is halved. Originally, miners received 50 bitcoins per block, but the reward has halved several times over the years and currently amounts to 6.25 bitcoins per block. This event is deeply rooted in the protocol of the Bitcoin network and is primarily used to control inflation and gradually approach the maximum amount in circulation of 21 million bitcoins.

The Mechanism of the Bitcoin Halving

Bitcoin Halving is an automated process within the Bitcoin protocol that aims to halve the amount of newly generated Bitcoins per block. This happens every 210,000 blocks, which takes approximately four years, based on the average time it takes to mine a block. The process is a core component of the deflationary nature of cryptocurrency, which aims to avoid inflation and increase the value of the currency in the long term.

Original block reward and its adjustments

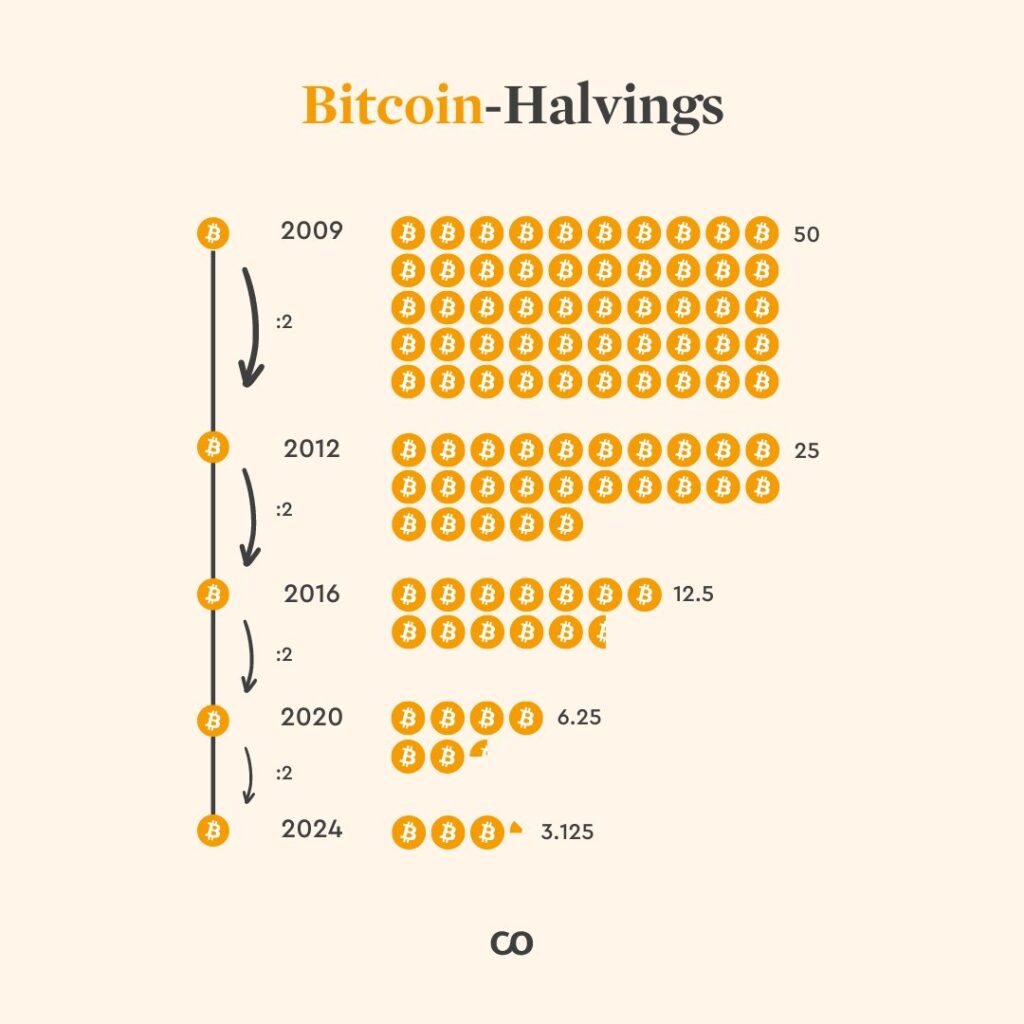

When Bitcoin was launched in 2009, the block reward was 50 bitcoins per block. This reward is halved every four years through halving:

- In 2012, the first halving, the reward was reduced from 50 to 25 bitcoins per block.

- The second halving took place in 2016, which further reduced the reward to 12.5 bitcoins.

- The third halving in 2020 halved the reward again to 6.25 bitcoins.

- The next planned halving, which will take place in 2024, will reduce the reward to 3.125 bitcoins per block.

Technical details and block time

Bitcoin blocks are created through the mining process, where miners solve complex mathematical problems to validate and add new blocks to the blockchain. The average time it takes to mine a block is estimated to be around 10 minutes. However, this time can vary as it depends on the overall computing power of the network, which is measured in the hashrate.

Bitcoin Halving block rewards

It is important to understand that the actual time between blocks can be random, depending on the fluctuation of the network hashrate. This can sometimes result in blocks being found faster or slower than the 10-minute target. The Bitcoin protocol adjusts the difficulty of mining every 2,016 blocks to ensure that the average block time remains close to 10 minutes. This “difficulty adjustment” is crucial to keep the release rate of new bitcoins constant and secure the network.

Long-term economic implications

Limiting the amount of Bitcoin to a maximum of 21 million is a crucial factor that supports the deflationary nature of the currency. By halving, this upper limit is gradually reached without more Bitcoins ever being created. This artificial scarcity is intended to help ensure price stability and avoid inflation, similar to precious metals such as gold.

Halving not only reduces the amount of new bitcoins introduced into the system, but also affects the profitability of mining. Miners receive a reward for their block processing and network security efforts in the form of newly generated bitcoins and transaction fees. With each halving of the block reward, the direct remuneration from the new minting of Bitcoins decreases, which increases the importance of transaction fees in the miners’ income.

Future halvings and their potential effects

The next halving after 2024 is expected to take place in 2028, with the reward decreasing to around 1.5625 bitcoins per block. This progressive reduction will continue until the block reward tends towards zero, which is expected to be reached in 2140. From this point, no more new bitcoins will be generated through mining and the only reward for miners will be transaction fees.

These planned halvings are fundamental to understanding the economics of Bitcoin and play a central role in the long-term strategy of investors and users of the Bitcoin network. Their implications are profound, both in terms of the macroeconomics of the cryptocurrency and the individual strategies of miners and other market participants.

Read also: Bitcoin Halving – mechanisms, forecasts and factors influencing price development

Market Theory and the Role of Speculation in Bitcoin Halving

The dynamics of the Bitcoin price are not only influenced by internal events such as the halving, but also by external market theories and the behavior of market participants. At the heart of the discussion is speculation, which can cause both short-term volatility and long-term price support.

Fundamentals of market theory

Market theory states that the price of an asset is determined by the balance of supply and demand. For Bitcoin, this means that any change in the quantity available (for example, due to halving) or a change in demand (due to new investors or changing perceptions) can affect the price.

Supply and demand

Halving reduces the supply of new bitcoins coming onto the market. If demand remains constant or increases, this could theoretically lead to a higher price. Historical data shows that halvings in the past have often been followed by a price increase, with this effect sometimes being priced in months before the actual event.

Priced-in expectations

Market participants often anticipate upcoming events and adjust their trading strategies accordingly. In the case of the Bitcoin Halving, it is a widely known and predictable event, which means that many of its effects may already be priced in before the actual Halving. This means that the actual act of halving may not have an abrupt impact on the price, as the market has already adjusted in advance.

Read also: The looming demise of the US dollar and the role of Bitcoin in the future financial world

Speculative Dynamics and their Impact

Speculation plays a central role in the pricing of Bitcoin. The volatility of Bitcoin is sometimes high, as speculative trades make up a large part of the trading volume.

Short-term speculation

Bitcoin price development after halving

Before and after a halving, speculative waves can cause prices to fluctuate considerably. Traders try to profit from the expected movements, which can lead to short-term price changes that do not necessarily reflect long-term market fundamentals. For example, the Fear of Missing Out (FOMO) can lead to a rapid price increase, as has sometimes been observed in the months leading up to a halving.

Long-term speculation

In the long term, many investors are betting on the scarcity of Bitcoin as the main price driver. The theory is that due to the fixed cap of 21 million Bitcoins and the reduction in new supply caused by the halving, the currency will rise in value against inflationary fiat currencies. This long-term speculative view often supports a general upward trend in price, although significant setbacks can occur due to market cycles and external events.

External influences and market reactions

In addition to internal mechanisms, external events also have a significant impact on the Bitcoin price. Geopolitical uncertainties, economic crises and regulatory developments can all have a significant impact. For example, geopolitical tensions or economic crises in the past have led to increased demand for Bitcoin as a “safe haven”, which can drive prices up in the short term.

Correlation with traditional markets

Interestingly, Bitcoin shows periods of both correlation and decorrelation with traditional markets such as stock indices and precious metals. In times of global financial uncertainty, Bitcoin can be seen as either a safe haven or a risky asset, depending on general market sentiment and specific circumstances, which can lead to a complex and often counter-intuitive market reaction.

The interplay of internal events such as halving and external market influences results in a dynamic and often volatile market environment for Bitcoin. Speculation, both short and long term, plays a crucial role in this and is further amplified by Bitcoin’s unique characteristics, such as its limited supply and decentralized nature. Analyzing these factors is essential for understanding Bitcoin’s price performance and for strategizing investors and traders in this market.

Read also: Detailed analysis of the Bitcoin Halving and its implications

The Future of Bitcoin and Predictions after the Halving

The long-term outlook of Bitcoin, especially after a halving, remains a key topic in the crypto world. While the direct impact of a halving on the short-term price may prove to be minimal, the long-term effects on supply, demand and market psychology are much more incisive.

Long-term economic effects of halving

Reduction in supply and inflation

Each halving effectively reduces the rate at which new Bitcoins are created from 6.25 to 3.125 Bitcoins per block in the next event in 2024. This reduction in supply, if demand remains the same or increases, has traditionally led to an increase in the price of Bitcoin. It is important to note that this halves Bitcoin’s inflation rate, which makes Bitcoin more attractive compared to inflationary fiat currencies such as the US dollar, whose money supply is constantly increasing.

Scarcity and increase in value

The maximum quantity of 21 million Bitcoins is a fundamental feature that positions Bitcoin as a store of value similar to gold. The scarcity of supply enforced by halving can be seen as a kind of automated, predictable monetary policy aimed at promoting value stability and combating inflationary trends.

Forecasting models and price predictions

Stock-to-flow model (S2F)

The stock-to-flow model, which is often used to value precious metals such as gold and silver, is also applied to Bitcoin and predicts potentially higher prices after each halving. The model measures the ratio between the existing quantity of an asset (stock) and the quantity that is newly produced each year (flow). A higher ratio indicates a higher scarcity and theoretically a higher price. For Bitcoin, the model shows that after each halving, if the flow rate is halved, the value of Bitcoin could increase, assuming that demand remains the same or grows.

Long-term market acceptance

The increasing acceptance of Bitcoin as a means of payment and as an investment, reinforced by the involvement of institutions such as Fidelity and BlackRock, supports the assumption that demand for Bitcoin will continue to rise. This development could continue to drive price increases, especially in times of economic uncertainty when investors are increasingly investing in non-inflationary assets.

Uncertainties and risk factors

Regulatory developments

Bitcoin is increasingly the focus of regulatory monitoring worldwide. Strict regulations could limit the acceptance and free trade of Bitcoin, which could affect its price and popularity.

Technological and security aspects

Further developments in blockchain technology or serious security breaches could also have a significant impact on the price of Bitcoin. While technological improvements such as the implementation of Schnorr signatures or Taproot could improve the functionality and efficiency of Bitcoin, security incidents could shake confidence in Bitcoin.

The future of Bitcoin after a halving looks promising, but not without caveats. While Bitcoin’s scarcity and predictable monetary policy are fundamental strengths that could support its value in the long term, much depends on external factors such as the global economic situation, regulatory decisions and technological developments. Investors should keep these variables in mind when evaluating Bitcoin’s long-term price performance after a halving.

Conclusion

The Bitcoin Halving is a key event in Bitcoin’s life cycle that can have significant short and long-term effects on the price. While short-term effects are often quickly absorbed by the markets, the halving could lead to an increased perception of Bitcoin as a valuable, scarce asset in the long term. However, as with all investments, uncertainties remain and investors should be aware of the many variables that can affect the market.

Author

Ed Prinz serves as Chairman of https://dltaustria.com, the most renowned non-profit organization in Austria specializing in blockchain technology. DLT Austria is actively involved in the education and promotion of the added value and application possibilities of distributed ledger technology. This is done through educational events, meetups, workshops and open discussions, all in voluntary collaboration with leading industry players.

👉 Telegram

👉 Website

Disclaimer

This is my personal opinion and not financial advice.

For this reason, I cannot guarantee the accuracy of the information in this article. If you are unsure, you should consult a qualified advisor you trust. No guarantees or promises regarding profits are made in this article. All statements in this and other articles are my personal opinion.